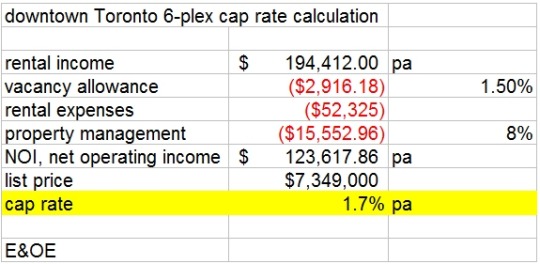

Any time a client is thinking of purchasing a 6-plex in downtown Toronto based on these numbers, you can be pretty sure a property bubble has formed:

A 1.7% cap rate is far below what is needed to make this property cashflow.

The only reason I can think of why someone might buy this is the greater fool theory, which works along these lines:

It’s

like when you played musical chairs as a little girl or boy—there was always

someone left without a chair when the music stopped. It’s called the greater

fool theory because you believe (irrationally) that there is always someone stupider than you are who’ll buy it for more

next year… until, of course, there isn’t, ie, you run out of fools.

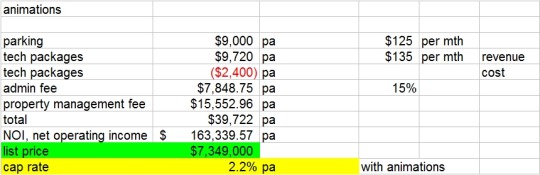

Even with animations, the cap rate only creeps up to 2.2%, viz:

Still completely unacceptable.

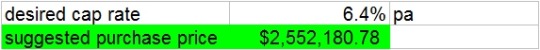

So what should someone actually pay for this place? Well, if your target cap rate is, say, 6.4% pa (which is about where it should be or, at a minimum, above 5%), this is easy to calculate–

So a purchase price of around $2.5 million for this 6-plex makes sense.

$7.349 million?

Not so much.

Bruce M Firestone, PhD

ROYAL LePAGE Performance Realty broker

Ottawa Senators founder

Real Estate Investment and Business coach

613-762-8884

bruce.firestone@century21.ca

@profbruce

profbruce.tumblr.com

brucemfirestone.com

making impossible possible

postscript: I also refer to this irrational exuberance as a “Toronto sickology.”

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.