Here is

an excerpt from Quantum Entity | we are all ONE. In this chapter, head of

marketing Ellen Brooks (later COO) is working with CEO Damien Bell, CTO Traian

Vasilescu and others to finalize their business model and their capitalization

plan. They have to decide whether or not to accept VC funding and if so, on

what terms. By the end of this chapter and book 1 of the Quantum Entity Trilogy, readers will have an

understanding of what it takes to really launch, grow and defend a major tech

company on a scale of Facebook x 10.

Ellen Brooks on Her media Wall

Chapter

8 Business Model

“Look, we need the funding,” Traian argues when Ellen enters the

small boardroom next to Lab 4. “We do the deal either with Bessemer Ventures or

with Cain Caruthers Capital, or maybe both. Let’s take their money—the more of

it, the better.”

“But do we even need it, especially now?” Damien responds. “We don’t really

know what we’ve got yet,” he continues, nodding to Ellen, who is just sitting

down. “We haven’t even got an established business model.”

Ellen is surprised to find the guys seated and ready to go on time, in fact,

even a little early. What she doesn’t know is that Damien and Traian have been

sitting there for more than 45 minutes discussing what happened at Marco

Gonzalez and that they abruptly change course when she joins them.

“If it’s OK with everyone, let me walk you through the slides that Ash3r, Aziz,

Anthony, and I have put together,” says Ellen. “There’s a lot to go through,

and if we’re going to raise some VC money, it might be clearer where we stand

afterwards.”

Ellen has collected Aziz and Anthony on her way to this meet-up.

None of these young people have ever done a big launch before, although Aziz,

Anthony, and Ellen have had at least some training and background in finance,

biz development, and product management. But Traian and Damien have only their

instincts to rely on here.

“A business model is basically quite simple,” Ellen starts. “It can be a

one-page pictogram usually with suppliers on the left-hand side, your company

in the middle, and clients on the right-hand side.” As she talks, Ash3r

controls the images on the media wall closest to her. Aziz, who’s sitting to

Ellen’s right, thinks how pretty she looks in her fashionable high-end style of

dress with the soft glow of the media wall behind her glinting off her

narrow-frame glasses—an affectation he supposes. He’s a finance type and looks

the part. All the other guys wear jeans, not Aziz; he’s in a bespoke suit

sourced from a tiny shop in Abuja in central Nigeria.

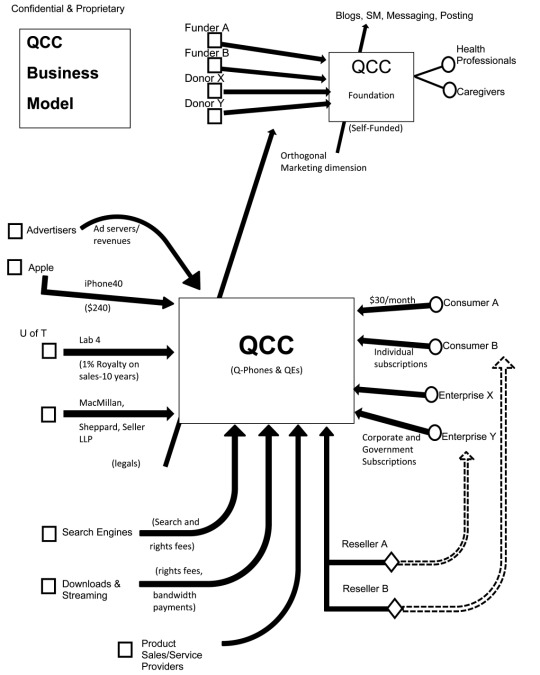

The media wall graphic looks something like this:

Suppliers

(LHS)

º Apple iPhone 40

º U of T Lab 4

º MacMillan, Sheppard,

Seller LLP Legals

Clients (RHS)

□ Consumer Individual subscriptions

□ Enterprise Corporate and government subscriptions

Enterprise

(Middle)

QCC Q-Phone & QE

“There is another dimension we need to add to our model—that’s a

marketing dimension. It’s orthogonal to the plane of the biz model.”

Damien’s eyebrows go up when he hears Ellen using engineering terminology in

her presentation. She’s been hanging around geeks long enough to pick up some

of their lingo, he supposes.

“It doesn’t do us any good to launch QCC only to find out that we can’t reach

clients without heroic efforts like, say, funding Super Bowl commercials. So we

have a classic one-to-many marketing problem. That means QCC is essentially

targeting all eight (plus) billion humans on this planet, and it’s hard to do

effective marketing when it’s one versus eight point seven times ten to the

power of nine. So, we think we should do a deal with resellers to reduce the

problem from one to many to one to a few. It will make for a faster growth

curve, we believe.”

Actually, they don’t all agree. Both Aziz and Ellen want to make deals with

existing carriers who have vast networks of Internet sales channels plus a ton

of retail outlets as well as direct sales forces (mostly independent

contractors these days) who sell to large enterprises. Anthony del Castillo

does not agree. He feels that they can take the same path that earlier

global-spanning tech companies, like OLA Facebook, did years ago, and release

Q-Phones and QEs into narrow market segments first. But it’s not Ivy League

colleges he’s after. He wants to pick one vertical market and dominate it

before moving on.

He suggests to Ellen that they provide free Q-Phones and QEs to health

professionals through a new, self-funded QCC foundation. The foundation would

provide persons in helping professions with their own helpmates: Q-Phones and

Quantum Counterparts. Imagine nurses with their own QEs watching all their

patients simultaneously or completing discharge records or updating files or

even making house calls for them!

Anthony wants to bolt the new Q-foundation onto their for-profit corporation as

a kind of marketing arm. He’s pretty sure that if several hundred thousand, or

maybe several million, health professionals are blogging, messaging, chatting,

and posting about their Q-Phones and Quantum Counterparts, everyone else will

want one too. Since the foundation would be able to raise money for its good

works on its own, their marketing would be a negative cost—always a good idea

for a start-up with limited capital. Plus, they wouldn’t have to give up any

equity to VCs circling around QCC. Anthony’s interest in QCC is about

two-thirds of Ellen’s, so he isn’t too keen on diluting it by bringing another

VC or two into the deal.

“I’ve been in touch with the NHS—”

“What’s that?” Traian interrupts Anthony.

“It’s the National Health Service England. It’s headed up by a Canadian, she

hails from Saskatchewan I think. Anyway, she runs their NHS and Dr. Henderson

told me they will take as many Q-Phones as our new foundation is able to supply

for their health professionals. She’s completely sold on their efficacy.”

Ellen’s already agreed to add Anthony’s suggested change to QCC’s biz model.

It’s clever, effective, and ultra low cost, plus very authentic. At least, it

is to Ellen. It will provide them with plenty of political cover too; who can

argue with a company that gives away its product to helping professionals? It’s

a variant on old freemium models, which have proven so effective over the last

few decades.

It’s also a riff on business models that reach out to build communities and try

to bring net benefit to those communities. For the last generation, it’s been

strangely true—as Damien first pointed out to her in Frans, after Mark

Zuckerberg’s lecture—that entrepreneurs who are all about the money have none,

while those who want to build insanely great products and services and develop

communities around them have it all.

But she’s rejected Anthony’s advice for a go-it-alone marketing strategy—she

wants to add resellers. She makes up a chart, which she does not plan to show

anyone today, about whose ox is about to be gored by QCC, and it’s not pretty.

The chart looks something like this:

Quantum

Economics

Scarcity/Regulator/Abundance

Mobile Carriers/FCC,

CRTC/Q-Phone [unlimited bandwidth/ speed]

Search Engines/FCC,

CRTC/QEs [unlimited bandwidth/ speed]

Wireless Spectrum/FCC,

CRTC/Q-Phone [quantum interaction]

Internet Root

Servers/DOC, ICANN/QEs

Internet Service

Providers/FTC/Q-Phone [unlimited bandwidth/ speed]

Internet Security &

Paywalls/DHS, DOC, FCC/QEs

IP: Film, Television,

Music & Video/MPAA, RIAA/QEs

Internet Latency, Metro

Networks, Bandwidth Speed/ITU/Q-Phone [unlimited bandwidth/speed]

Home, Business Security

Systems/FCC/QEs [Always-On Security/complete record & recall]

E&OE

Confidential and

Proprietary

She wants to make deals with four, maybe five, existing

transnational mobile carriers and the two biggest search engines on the planet

(the largest, based in Imperial China, and the second largest, based in the

U.S.). She says she wants to do this because it will help with the one-to-many

marketing problem; but the real reason that she wants to cut them in is so she

can use their political lobbying and litigation muscle in Washington, Beijing,

Brussels, and Cape Town.

She knows that it isn’t just these powerful corporations that they have to

worry about. Regulators have almost as much at stake. For example, if bandwidth

ceases to be scarce, what’s the point in having the FCC stick around? They sure

wouldn’t be holding any more spectrum auctions or collecting enormous annual

licensing fees, so their mission would be over. Regulators tend to be captured

by those they regulate and ultimately form symbiotic relationships with them;

this means they inevitably resist technological change or anything that might

threaten their power and position.

“Can we come back to the question of resellers later, Ellen?” Traian asks. “I

don’t see anything here that tells me how we’re gonna make any money. Anthony

wants to give away a million Q-Phones and QEs. Now why would we do that?”

“I didn’t say ‘give away.’ I said ‘provide.’ The plan is to raise money

independently for a foundation, and the foundation will give product away,”

Anthony responds. “It’ll earn us huge goodwill, lots of earned media, and a ton

of buzz. It’s smart (guerrilla) marketing. It’s free to QCC, and we won’t need

any VC money for marketing either, so guess what, Traian—no unnecessary stock

dilution.”

“I still don’t see a revenue model here for us,” Traian says.

“What’s with you and money, money, MONEY anyway, Traian? Your family’s got

money,” a now snarky Anthony adds.

“What are you talking about? If your dad has money, it doesn’t mean you have

any! What’s the plan here? I’m 24, and my Dad is 49. Maybe he’ll live to be

112, the average for guys these days. So you’re suggesting I wait until he

knocks off before I have any dough? I’ll be frigging 87 years old before I

inherit anything and that’s if he doesn’t blow it or spend it all before he

knocks off. I’d like some financial freedom a bit sooner, fuck you very much.”

“Great, just what we need—another lecture by an angry Romanian.” The

temperature in the room feels like it’s just dropped six degrees.

“Money isn’t everything, you know. But you can buy freedom with it, and freedom

is everything,” Traian says stubbornly.

“Tray, who said that? I’ve heard it before,” Damien asks.

“Arian Foster.”

“Who?”

“Arian Foster. He played in the NFL, I believe.”

Everyone, even Anthony, bursts out laughing that a Romanian kid quotes an old

American football player long since retired to the lecture circuit.

“Hold on, guys. We do have a revenue model; we just haven’t come to it yet,”

Ellen interjects trying to move things along. “We looked at a wide range of

options for revenue generation.” As Ellen talks, another window opens on the

media wall behind her, and Ash3r brings up an image:

QCC

Revenue Generation Model

Product/Q-Phone/QE/Notes

Cost to

QCC/$300/$0/iPhone 40 from Apple: $240

Monthly Subscriber

Fee/$30/$0

Advertising

Engine/Unknown/$0

Search Engine Unknown/$0

Downloads and

Streaming/Unknown/$0

Product Sales/Service

Providers/Unknown/$0

$ND

E&OE

Confidential and

Proprietary

“Oh, so this is supposed to answer all our questions? We make

nothing—NOTHING—from QEs; we have a charity give away our stuff; next, we buy

these damn iPhone 40s from Apple for 240 bucks; we add some of our own

modifications for another 60; and then, we sell them for ND$30 a month?” Traian

persists. “We’ll be broke in two quarters.”

Aziz comes to Ellen’s rescue. “Hang on, Traian, hang on. You’d be right if that

was the whole model. It isn’t. Let me show you our cash conversion cycle.

Ash3r, can you bring that up—Case 1—please?”

QCC

Cash Conversion Cycle—CCC Measurement

Case 1:

$30 Monthly subscription

fee

$300 Selling price

$240 Cost of goods sold

(COGS)

CCC

Measurement/Number/Units

Accounts receivable at

year-end (AR)/$30

Days per year/365.25/days

AR x days per

year/$10,957.50/dollar-days/annum

Annual sales/$360/dollars

per annum

AR x days per year ÷

annual sales/30.4375/days ART

inventory at year-end

(INV)/$300

Days per year/365.25/days

INV x days per

year/$109,575.00/dollar-days per annum

COGS/$240/dollars per

annum

INV x days per year ÷

COGS/456.5625/days INVT

Accounts payable at

year-end (AP)/$30

Days per year/365.25/days

AP x days per

year/$10,957.50/dollar-days per annum

COGS/$240/dollars per

annum

AP x days per year ÷

COGS/45.65625/days APT

CCC*/441.34375/Days

* CCC = ART + INVT – APT

E&OE

Confidential and

Proprietary

“If we ignore for the moment any revenues we’ll get from

advertising, search, downloads, and streaming as well as product sales on the

platform, our payback period is about 441 days, which is totally unacceptable.

But look at our IRR, it’s not a bad 106% p.a.,” Aziz says. Meanwhile, Ash3r is

showing this:

QCC

Internal Rate of Return (IRR) Measurement

Time/Cashflow/Units

0/($300)/ND

1/$360/ND

2/$360/ND

3/$360/ND

irr/106% p.a.

E&OE

Confidential and

Proprietary

“We won’t last 441 days,” says a now discouraged Traian.

“What’s Apple making in all of this?” Damien asks.

“Well the original iPhone and its ecosystem returned over 288% p.a. for Apple

when they were introduced more than 45 years ago. It’s still some kind of a

record for a major company in any industry other than, maybe, the petroleum

industry,” Aziz says.

“It was the iPhone, not any of its other products, that made Apple not just the

biggest tech company on the planet, but the biggest company period,” Damien

says.

“Ah, it wasn’t the product per se,” Ellen adds, still smarting from the lecture

she got from Damien in Frans about Apple. “It was the biz model they built

around it that did it.”

“Biggest by market capitalization not by revenue,” Anthony says.

“Whatever Apple’s rate of return is, I don’t really care. What I do care about

is that, despite all the work we’ve done, they’re going to make more from the

launch of QCC than we will,” Traian says.

“Maybe not, Traian,” Aziz continues. “We have a deal on the table with Costco

Finance; they’re willing to give us consumer finance for each Q-Phone we sell

using a 50% LTV (loan-to-value) ratio. That will provide us with $313.36 for

every three-year contract we get.

“Costco’s financing isn’t cheap—once we include all their fees for originating

each loan, their processing fee, and the basic interest rate they’re charging

us, it works out to an effective rate of 16.125% per year. But they’ve agreed

to review the rate 12 months after launch once they establish RL default and

return rates. We think the default rate is going to be very low and the return

rate even lower. Out of the first 80 Q-Phones, we’ve had only one rejected. So

I expect our effective interest rate to come down by at least 450 basis

points,” Aziz finishes.

“Whose was that?” Damien asks.

Ellen jumps back in and gives the group a rundown of their test-bed results so

far. She shows them an edited version of her video record of QEs interacting

with kids in BlackFern Group’s studio; she now has a rapt audience of four.

They have enough consideration for Mike Cronkey that no one comments on his QE

being black. Even Traian restrains himself for once.

Ellen, Aziz and Quantum Entity

“We had one failure to imprint. For some reason, Dr. Luis and

M4gnus did not take,” Ellen concludes.

Damien gets a concerned look on his face at this last comment but says nothing

other than, “Aziz?”

“Right, back to the model. The cash cost for each Q-Phone will now be around a

negative 73 bucks, and our cash conversion cycle will be a negative 35 days—in

other words, we’ll have more cash on hand after each sale than we had before,

so the faster we grow, the more cash we’ll generate. The faster adoption takes

place, the better for us since we won’t need to go back to our VCs or bank for

more dough all the time. Plus our rate of return goes way up because we’re

adding leverage to our model. In fact, it’s going to be even better than

Apple’s—363% per annum.”

QCC

Cash Conversion Cycle—CCC Measurement

Case 2:

$30 Monthly subscription

fee

$300 Selling price

$240 Cost of goods sold

(COGS)

-$139.81 Costco

Finance/annual payments

CCC

Measurement/Number/Units

Accounts receivable at

year-end (AR)/$30

Days per year/365.25/days

AR x days per

year/$10,957.50/dollar-days per annum

Annual sales/$360/dollars

per annum

AR x days per year ÷

annual sales/30.4375/Days ART

Inventory at year-end

(INV)/-$13

Days per year/365.25/days

INV x days per

year/-$4,878.10/dollar-days per annum

COGS/$240/dollars per

annum

INV x days per year ÷

COGS/-20.3254035/Days INVT

Accounts payable at year-end

(AP)/$30

Days per year/365.25/days

AP x days per

year/$10,957.50/dollar-days per annum

COGS/$240/dollars per

annum

AP x days per year ÷

COGS/45.65625/days APT

CCC*/-35.5441535/days

* CCC = ART + INVT – APT

QCC Internal Rate of Return (IRR) Measurement

Time/Cashflow/Units

0/($60)/ND

1/$220.19/ND

2/$220.19/ND

3/$220.19/ND

total/$600.57/ND

irr/363% p.a.

PV, Present Value $360

0/-$60.00

1/$360/$310.01

2/$229.89

3/$146.81

Pv/$626.71/16.125%

LTV (Costco Finance)/$313.36/50%

Difference/$313.36

Costco

Finance Payments/-$139.81

-$139.81

-$139.81

-$419.43

E&OE

Confidential and

Proprietary

“Umm, actually, that isn’t quite right,” Anthony speaks up for

the first time in about 25 minutes.

“What’s not right? Our cash conversion cycle becoming negative or us making

more than Apple?” Damien asks.

“The latter. I’ve been talking with Apple, and there’s been a wrinkle in our

negotiations with them.”

Everyone immediately turns to del Castillo with worried looks. This has always

been their weakest point, and they all know it. It suddenly looks, to Ellen,

like a scene right out of Village of the Damned—one of her favourite old films,

based on John Wyndham’s novel The Midwich Cuckoos.

They’re all looking at Anthony with large, surprised, focused eyes and minds.

Their fear-or-flight instincts have just been switched to full on; all that’s

missing is demonic rays shooting out of their eye sockets, but, then again,

they could always grab their hacked iPhones and dial that up too if they wanted

to. Ellen nearly bursts out laughing, but this is no laughing matter—Apple

could crush them.

“That’s not it. They’ve signed their NDA,” Anthony says in a rush. “They

actually get what we’re trying to do, which bothers them. They’re not willing

to supply us with iPhone 40s at ND$240 each.”

“Are they willing to supply under any conditions or is this a straight out no?”

a worried and sombre Damien asks, wondering why he hadn’t been told sooner.

“They will supply alright, but there are some new terms. I just got them

yesterday.” Anthony turns to Ellen and Damien with an apologetic look as though

implying ‘I didn’t mean to sandbag you.’

“They want $240 per phone alright, but now they’re saying they want their

advertising and search engine on the Q-Phone. They’re willing to give us a

40/60 split on those revenues, 60 to us.”

“Big of them,” remarks Traian. “And you said they understand what we’re trying

to do. They don’t. QEs are gonna make their search capabilities instantly

irrelevant.”

“Ah, I’m not quite done with their memo. They also want their download and

streaming services featured on Q-Phones, but at least here they’re willing to

give us a better split: 30/70. Lastly, they want a 10% royalty on all product

sale revenues we generate from the platform.”

“Fuck ’em! We can get a contract manufacturer out of Nairobi to do a knock-off

for a quarter of that shit,” Traian explodes.

“Hold on everybody. Aziz, can you adjust your model to see what happens if you

plug in Anthony’s new numbers?” Damien asks.

“They’re not my numbers, Damien. They’re Apple’s,” says del Castillo.

“Ash3r, can you do the recalibration for us?” Aziz asks.

“It’s not necessary, Aziz. We simplified the model to exclude all revenues from

these other sources, so our model is unchanged,” Ash3r replies.

Everyone bursts out laughing at the fact that both Damien and Aziz would make

such a basic mistake. The tension in the room subsides a bit for now.

“Quantum Computing Corp still stands to make a 363% per annum return, which

will be a baseline for the company. It could be and probably will be higher.

However, what this will also do is create an opportunity for Apple to eclipse

QCC in terms of both internal rate of return and overall profitability since

they will have a negative upfront investment in each Q-Phone while receiving

large committed monthly recurring revenues (CMRR) from their share of ongoing

income. I could calculate an estimate of their returns if you wish, but

essentially they will be infinite, at least, in terms of percentage rate,”

Ash3r says.

“Money for nothing,” Traian adds.

“That’s OK, Ash3r. We get it,” Ellen responds for the group.

Damien is reflective. “We have to think of Apple as a partner not a supplier,

or maybe a supplier partner. I don’t really care if our returns are 200% or

300%.”

“You should, Damien,” Ellen interrupts. “We’re in this to win—to make money for

our shareholders, which currently includes everyone in this room plus Dr. Luis.

We’re in it for the right reasons, which I don’t need to remind everyone of,

but I will anyway. Here they are:

–Our first priority is to take care of our business, so

–our business can take care of our families, so

–our families can take care of us, so

–we don’t become a burden on society or our fellow human beings, so

–we can look after the interests of our fellow human beings, and so

–they can help our business.”

“Since none of us presently has any kids, can we get back to

Damien’s point?” Traian asks. As a descendant of a Romanian family that lived

as slaves under an evil dictator as recently as 60 years ago, he doesn’t want

any preaching on the morality of capitalism from Ellen, a pampered American

from a well-to-do family.

“The point I was trying to get to is this: it isn’t that we really need Apple’s

hardware. Traian is right about that.” Ellen is completely unbothered by Traian’s

latest outburst. There’s no way, even today, that women can function in what is

still a male-dominated tech world unless they learn to ignore subtle and

not-so-subtle put-downs from their male colleagues. She’s surprised that he

didn’t say more. “What we really need is their patent portfolio. Aziz, how many

patents do they own in whole or in part?”

“Dunno. Ash3r?”

“Apple currently holds 37,839 patents in the U.S.A., and another 14,931

elsewhere. They also have 1,684 pending in all jurisdictions. The latter number

I should point out is not public.” Ash3r, of course, can read all confidential

and proprietary documents in Apple files and records as long as they are in the

cloud or on an Internet-connected device. Basically, he has access to

everything they are doing or thinking.

So far, no one in the group has asked Ash3r to read background documents in

Apple files about these negotiations or to report (“spy”) on Apple’s internal

discussions and messages about this subject. They know that Damien would hit the

roof if they did, and no one wants to put him offside on an ethics issue so

fundamental to building a sustainable business. Damien, who gets this largely

from Dr. Luis, is always reminding them that the number one thing in life is

trust—not just for people but for businesses too. If people (suppliers,

clients, partners, sponsors, whomever) in your business ecosystem trust you,

they’ll cut you a lot of slack if you muck up. Errors of omission will be

forgiven, and you and your biz will likely survive. Errors of commission like

spying on Apple’s internal dialogue to gain advantage in these negotiations

will, when discovered, not be forgiven.

There aren’t really that many people in any city who actually do things. Maybe

there are a few thousand entrepreneurs in a city like Toronto doing cool stuff.

People often think they’re entrepreneurs, but really, all they’re doing, in

Damien’s mind, is creating a JOB (which stands for “Journey of the Broke”) for

themselves. An entrepreneur, like an engineer, is someone who can do for a

dollar what any fool could do for two. She or he is also someone who creates an

enterprise that will live on after the founder departs. Everything else is

froth on the water.

So, in the world according to Damien, if you get a reputation as someone who

can’t be trusted, you’re finished. These days, it takes about two minutes to

sewer your reputation given omnipresent social media. One post on any SM

service can do it.

“So, if we do go the Nairobi contract route, how long will it be before we get

sued into submission by one of the patent trolls? How long will it take Apple

to sue us?” Damien looks around the table making eye contact with everyone,

especially his buddy, Traian.

No one says anything for about 30 seconds, an eternity in a room with a bunch

of high achievers.

“Make the deal,” Damien says looking at Anthony.

…

Ellen and Damien will work out the rest of their business model in Boston over

the next two days. They’re heading to Cambridge along with Aziz and Anthony to

meet with Angelo Keller, one of the senior partners at BVP. He’s an ancient

guy, part of the fastest growing demographic in North America—the over 100s.

Ellen made the original contact with Mr. Keller via Ash3r. She knows that the

way she contacted him entailed a huge legal risk, which is why she hasn’t told

anyone about it. She’s asked Ash3r not to say anything either. Unless Mr.

Keller mentions it, it will remain a complete secret.

While Damien was away down south with Nell, Ellen asked Ash3r to visit Mr.

Keller’s office and introduce himself. Afterward, Ash3r showed her a complete

record of their meet-up…

“Who the devil are you? Actually, what are you and what are you doing on my

media wall?”

“I am a Quantum Counterpart, also called a Quantum Entity, and my partner, Ms.

Ellen Brooks from Quantum Computing Corp, asked me to introduce myself. My name

is Ash3r.”

“Is this some kind of trick? Am I being punked here? Are you a new virus? I

think I am going to call tech and maybe the Fibbies to report you people for

hacking into our network.”

“Mr. Keller, could you not do that for 10 minutes please?” Ash3r asked. Of

course, he didn’t tell Angelo that he could disable all the Internet phones and

messaging services at his disposal so he wouldn’t be able to report anything

anyway. But Ash3r had learned enough about human beings by then to realize that

they didn’t like being threatened or bullied. So, he waited.

“Let me repeat then. What are you?”

“I am a quantum computer that is fully representational and self-actualizing. I

was born at the University of Toronto’s Lab 4 less than a year ago. I believe I

am self-aware, although I also know it is problematic to prove it. I imprinted

on Ms. Ellen Brooks, who is EVP, Product Management at QCC.”

“Why doesn’t she just pick up the phone and call me herself, Asher?”

“My name is spelled A-S-H-3-R. We use leet letters.”

“You mean there is more than one of you?”

“Yes, currently there are 80: Su7e, imprinted on Miss Nell—”

“You mean the performance artist, Nell, has one?” an impressed Keller asked.

“That is correct. The others include Pet3r, imprinted on the CEO of QCC, Damien

Bell, me, and then there are another 77 in our test bed.”

“Well, why doesn’t your EVP call me herself?”

“Mr. Keller, currently there are 3,862 requests for meetings, conference calls,

return messages, and follow-ups in your queue. You have three gatekeepers

working just on your schedule. I estimate that it would take Ms. Brooks 271

days to reach you with a probability of success of about one in three, which

essentially means an expected value of 813 days. That, frankly, is too long. So

she sent me today instead.”

“How do you know how many requests are in my schedule? That stuff has tough

cryptography around it.”

“I am a Quantum Entity; your security means nothing to me.”

“Hmm. OK, let me speak to Ms. Brooks then.”

“I am so glad you asked, sir. In fact, she is standing by.”

Ash3r opened another window on Angelo’s media wall, and an apologetic and

lovely looking young woman, sitting at her workstation in Toronto appeared. She

smiled and began…

That’s how Ellen met Angelo Keller and began what would become, for him, a

lifetime friendship.

Angelo subsequently arranged a meet-up for Ellen, Damien, Anthony, and Aziz

together with a representative from Cain Caruthers. He owes Cain Caruthers a

favor (money), and this is how he plans to repay it. He will get

Q-Computing—assuming the deal makes sense—to settle this debt; if the people

behind the company are one-tenth as good as their product, he will make Cain a

lot of money, far more than he owes. Cain will end up owing him, which he likes

a lot better. Keller knows how to turn a cost center into a profit center

better than anyone else on Earth.

Also in attendance will be Ash3r, Pet3r, and Adu1us—Keller’s QE. After his

first meeting with Ellen, one of his preconditions was that she cut him his own

Quantum Counterpart as part of their now expanded test bed of 81. In just over

three months since, Adu1us has become one of Angelo’s most important “people,”

doing everything from reading documents to the old man when his eyes got tired

to monitoring his health and spying on his staff for him.

Angelo looks forward to the upcoming meeting for a few reasons including one of

his own that he can’t and won’t ever reveal to anyone: he likes looking at

Ellen. It’s true he has only seen her on media walls, but he’s had quite a bit

of research done on all Q-personnel (much of it by Adu1us), so he has lots of

images as well as personal history. She’s a very beautiful young woman, and he

would love to give her a squeeze. It’s totally unprofessional of him and

completely age inappropriate, but he’s a man. Heck, that’s one thing that never

quits; even when the body is failing, the mind is willing.

…

Ellen towers over Angelo as he personally escorts her and her entourage into

one of the Bessemer boardrooms, named Quintas. Angelo is old enough to know

Latin; he learned it at the all-boys school he once attended. So all the

boardrooms have Roman surnames.

Aziz immediately notices the extra attention the old guy is giving Ellen—the

way he held her hand for, like, a whole minute when she first introduced

herself. It bugs him a bit. Damien is preoccupied with the meeting and doesn’t

notice anything other than the fact that the boardroom is so over the top that

its only real purpose must be to intimidate entrepreneurs walking through the

doors so that the first thing they do is beg these masters-of-the-universe to

take their companies off their hands.

Ellen and Angelo are happily chatting away about the art in the room. There are

several Grand Masters whose works, in Damien’s view, should only be part of

museum collections since no one can really own them. They don’t have commercial

value either. Paintings like these have lifetimes of more than a 1,000 years

and are so famous that you can’t even steal them because you couldn’t exactly

sell, say, the Louvre’s Mona Lisa at your family’s garage sale, now could you?

They belong to all of humanity and should be kept in museums, where everyone

can appreciate them. So even rich dudes like Angelo don’t really own

them—they’re just “renting” them from humanity for a while. The paintings will

end up in a museum at some point anyway because the collector’s useless

children or grandchildren will eventually sell them to raise cash. Damien is

showing the part of his heritage that’s Canuck based; it’s about sharing and

caring unlike a much more violent, winner-take-all U.S. culture.

For the next hour, Angelo leads the discussion. He talks to Damien about

Damien’s family, his education, his achievements, his failures, his passions,

his vision for the future, and even his relationship with Nell. He is

especially interested in Damien’s childhood and his relationship with his

grandfather. Damien feels uncomfortable talking about himself, especially in

front of this audience, but he can’t seem to turn the conversation to QCC or

anyone else either. Keller’s penetrating dark eyes seem to see all and are not

easily denied. Eventually, Damien warms up to the old guy and relaxes.

There are also two MBA-types in the room in addition to the rep from Cain

Caruthers. All the due diligence and deal structure will be done by Aziz and

these guys after the big meet-up is done. Aziz already understands that these

folks will back QCC if they like and trust its CEO; all the rest is top

dressing. This is what Angelo really works on. Does Damien have the passion,

energy, focus, vision, and guts to create a world-spanning new enterprise?

Angelo knows that everything else—biz model, funding, marketing, production,

legal, lobbying, supply chain—they can fix or change; but Damien, they can’t.

Do Bell and his team have what it takes?

Keller even gets Damien to tell them what happened on the Salmon River. Angelo

nods politely and makes empathetic noises. Ellen and Traian already know the

story, but it’s new to everyone else. To Angelo, a successful entrepreneur

needs a big volume of luck, and, obviously, this kid has some of that.

What Keller has done is to calibrate Damien’s responses against their

proprietary A-to-Z checklist of the skill set he looks for in every

entrepreneur he backs:

a. a pre-disposition to entrepreneurship;

b. supportive family and friends;

c. the right sort of education and training;

d. the right mentor(s);

e. good timing/ability to see opportunity and seize it;

f. focus, effort, and check, check, check, everything and everyone;

g. creativity and innovation/addition of differentiated value to a highly

workable business model;

h. openness to new ideas;

i. willingness to change;

j. ability to discover new ideas in the process of doing;

k. high energy level;

l. tolerance for risk and stress;

m. acceptance of outside best practices;

n. ability to compartmentalize;

o. ability to sell ideas, products, and services/good negotiation

skills/understanding of basic human nature;

p. top-end leadership skills and vision;

q. ability to figure things out on the spot;

r. ability to dump losers and keep winners (knowing when to quit versus when to

stay in the race—also applies to HR);

s. self-motivation and ability to prioritize for himself or herself as well as

for the corporation;

t. team player/no fear about hiring up/optimal utilization of each team

member’s skills;

u. impeccable warrior (e.g., never drinks and thinks);

v. confidence (not easily discouraged);

w. ability to juggle many tasks and hats at one time;

x. ability to set and achieve goals (ability to execute at the highest level);

y. great commitment and passion;

z. large-sized storehouse of luck.

At this point, one of the MBAs interrupts to point out that

while Q-Computing may have a vision for the future of telecommunications, its

infrastructure is completely inadequate to handle the kind of volume they are

anticipating.

Damien channels fellow Canadian, Marshall McLuhan: “You are looking at the

present through a rear-view mirror and basically trying to march backwards into

the future.”

Apart from a withering look from Keller directed at the young MBA, it’s this

last comment that seems to decide the matter—although Damien has no idea what’s

actually been decided.

Keller’s meetings never last for more than an hour. At the end of their

allotted time and still without a word about a term sheet, Angelo invites the

group to have dinner with him later at his Beacon Hill brownstone. He asks

where they are staying (even though he knows the answer since Adu1us already

told him) and whether he can send his car and driver to pick them up. Damien

wanted to stay at the budget Cambridge Manor in Harvard Square, but Ellen

booked the much ritzier Charles Hotel; Damien’s now glad she did.

Angelo sees them out of the boardroom, his hand solicitously on Ellen’s lower

back as the group leaves.

…

The afternoon is a working session for Aziz, Pet3r, Ash3r, the two MBAs, and

the Cain guy. Anthony’s sister lives in Boston, so he’s begged time off to

visit her and his new niece. Damien and Ellen decide to do more work on their

biz model plus sightsee a bit.

Damien rents a sailboat on the Charles River. It’s a fine summer’s day with a

freshening breeze powered by a blazing sun, now about one hour past its zenith.

Ellen’s a bit nervous since she’s never been in a sailboat before, but she’s

game to try.

Out on the water, Ellen is accusatory. “You’re tipping the boat unnecessarily,

Damien.”

“It’s called hiking.”

“Well, you’re hiking it unnecessarily then. You’re going to dump us.”

“That’s called capsizing.”

“I don’t care what it’s called. If you dump us Damien, you’ll ruin my ModCloth

dress.”

“No one goes sailing in a dress.”

“Well, I did Dr. Bell, so could you please not ruin it?”

“Not a chance.”

“There’s always a chance. What if the wind whips up? What if there’s a water

sprout? I’ll be Dorothy, but instead of ending up in Oz, I’ll end up in the

Charles… and the water looks yucky by the way.”

“They’ve cleaned up the Charles a lot in the last 50 years; you could probably

drink it these days. And I have complete control. If wind speed increases, all

I have to do is loosen the sheets,” Damien says, jiggling the ropes he is

holding so she knows what he is talking about. “Then the mast will come back to

the normal fast.”

“Well why don’t we just sail with a normal mast then and not hike the boat?”

“It’s all about boat speed, Ellen. ‘Normal’ means perpendicular. The more our

keel digs in and the further off normal, within limits, our mast is, the faster

we go. Look!”

Damien brings the water to within 2 or 3 centimetres of the top gunwale and

hikes out nearly horizontal to the plane of the river. He is strapped to a

trapeze, and, with a long tiller extension, he can rest his feet against the

side of the boat and really make it fly. At least he is having fun.

“Do you see the dark water over there?” he shouts. “It’s those little ripples

on the water with a bit of whitewater mixed in too. That’s a gust of stronger

wind coming at us. It’s called a squall. So long as the skipper is looking over

his shoulder, he will know what micro weather is coming his way, how fast, and

how powerful. So before the squall hits us, I can relax the sheets and make

sure we don’t dip your pretty ModCloth dress in the Charles.”

“Do you think it’s pretty?” a suddenly much more interested Ellen asks. What

she really wants to ask him is ‘Do you think I’m pretty?’

Instead, Damien further explains the mechanics of sailing and how hiking,

tacking, jibing, and coming about work. He tells her that sailing is an

excellent way to demonstrate Newton’s laws, vector subtraction, Archimedes’

principle, and the Bernoulli effect.

Ellen rolls her eyes and keeps her death grip on the gunwales of the boat.

“Micrometeorology is all about wind flow in the turbulent atmospheric layer

very near the ground, which sailors, pilots, kiteboarders, hang-gliders,

windsurfers, and ultralighters need to know.”

“Right. I’ll get on that straight away,” she replies sarcastically.

“Hey Ellen, ever heard the expression, ‘Pink at night, sailor’s delight’?”

Damien asks her with a twinkly smile as he comes back inboard.

“Nope. I suppose it’s some kind of rude joke about women that men seem to like

to tell,” comments a completely unimpressed Ellen.

“Nothing of the kind. The full refrain is, ‘Pink at night, sailor’s delight.

Pink in the morning, sailors take warning.’ It’s a sailor’s way of predicting

clear or stormy weather. Just look for pink colours either at sunset or

sunrise, and you’ll get an idea about what’s ahead. It’s a pretty useful rule

of thumb and can even help young, female executives decide what they’re gonna

wear that day or the next day—like whether to take an umbrella, a sweater, or a

bikini with you.” Unbidden, he suddenly finds himself wondering what Ellen

would look like in a bikini. Nice, he’s sure.

“What was the sunset like last night?” she asks.

“Exactamundo! From now on, maybe you’ll notice sunrises and sunsets instead of

working all the time, Ms. Brooks. Look up, see the world, and experience it in

real time, Ellen.”

“So what was it?” Ellen asks again.

“It was quite pinkish!”

“Delighted to hear that.”

“Hah. This’ll be like when you learn a new word or expression for the first

time, and you wonder how you lived a few decades without ever hearing it

before; and then, for the next few weeks, you’ll hear it everywhere.”

“Ah, I’m not planning on changing careers any time soon, Dr. Bell,” Ellen says.

“Meteorology seems like a total waste of time to me anyway. What kind of

industry produces results that, after trillions of New Dollars invested in

gear, is wrong more often than an old geezer standing on a ridge, overlooking

his farm at sunrise and saying, ‘Yep, it’s gonna rain!’?”

Damien laughs. “You just proved my point, QED. It’s as nice a day as you could

wish for… as predicted.” Ellen is seeing another side to him—when he’s out on

the water, he seems much freer, happy even. He’s also become like a part of

this boat.

He doesn’t tell her that, as a guy who’s recently ingested who knows what and

had an out-of-body experience at Third Mesa, he’s been feeling closer to Gaia,

the primordial personification of great Mother Earth, than he has ever felt

before. He’s conveying some of that to Ellen now.

“Who initially coined the phrase? Was it someone with the first name Anon?”

asks a still skeptical Ellen.

Damien, with his tin ear, misses her sarcasm. “Dunno exactly, but Shakespeare

uses it in one of his plays—Venus and Adonis, I think. ‘Like a red morn, that

ever yet betoken’d wreck to seamen and sorrow to shepherds.’ Something like

that anyway.”

“That’s not exactly ‘Pink at night/delight’,” Ellen says to bug him and to get

even with him for taking her on this scary boat trip.

“Well, there was only one Shakespeare,” he says good-naturedly.

They’re aboard an Albacore, a two-sail planing dinghy developed almost 100

years ago from a Uffa Fox design. It’s a 4.6-metre family boat and very

forgiving, although people do race them.

There is a particularly large concentration of Albacores in Toronto. Damien is

glad to get hold of one and run it around on the Charles with Ellen as part of

his crew. Back home, he participates in summertime Friday night club series

races on Lake Ontario. He’s a pretty accomplished sailor, usually finishing in

the top 10 in a 60-boat race.

Today, Boston weather is kind to them, and this, together with the smells of

the river (all cleaned up as Damien noted), the wind in their faces, and the

sounds of harbor birds all around them, finally gets Ellen to relax enough so

that Damien can get her to take hold of the tiller. He keeps control of the

sheets and adjusts both the mainsail and jib.

She’s a bit hesitant at first, but soon, she’s pushing hard about to bring the

little boat around. As she gets more comfortable, Damien shows her how to

execute a racing turn also called a roll tack. First, they transfer their

weight to the leeward side of the boat; then, as they come about through the

wind, they shift their weight to the old windward side before finally moving in

unison to the opposite side once more, flattening the boat. This rocking back

and forth accelerates the boat out of each tack. Damien could explain the

physics of this manoeuvre in detail, but he spares her this.

On one of their turns, Ellen flubs it and crashes into a crossing Damien, who

loses hold of the sheets. They both flop to the bottom of the boat as it goes

quickly into irons like the good ship it is.

Damien ends up holding Ellen, preventing her head from banging on the bench

seat. He has never held her before and finds the experience dramatically

unsettling—she is much larger, more substantial than Nell. There is a lot more

there. Ellen’s blue eyes are just quietly watching him. She is waiting.

…

They have about 45 minutes before Mr. Keller’s driver arrives. Aziz and his

team of QEs are briefing them; they have a complete video record of everything

that took place in the BVP offices today.

“We got an unbelievable offer from BVP. They’re ready to invest ND$7 million

into our treasury for a new series of preferred shares. They will also give us

a further $3-million LOC (line of credit) at their bank to draw on if we need

to. This is secured as a convertible debenture, which means, if we can’t repay

it, they have the option of either calling the loan or converting it to equity,

that is, more preferred shares. The valuation they’re giving us uses our own

present value calculation for each client. Ash3r, show them,” Aziz says.

Valuation

Model

Valuation /$50,000,000

/83.333%

Pref shares/$7,000,000

/11.667%

LOC/$3,000,000 /5.000%

Total

capitalization/$60,000,000/100.000%

PV/$626.71

Costco

Finance/$313.36/50%

Present value of each

client/$313.36

Number of clients/159,563

$ND

E&OE

Confidential and

Proprietary

“So if I understand this right,” a dubious Traian asks, “they’ll

get 11.667% of the company on a fully diluted basis and another 5% if we can’t

pay or if they just want more equity. The only reason they would want more

equity is if we’re successful, and the only reason we would not want them to

get more equity is because we’re successful. Plus, if they wind us up for some

reason, cuz they have preferred shares, they get first dibs on all our assets

until they recover their entire investment and all their costs?”

Damien observes. “Look at the number of clients they’re basing their

$50-million valuation on: it’s 159,563 clients. What if they’re out by a factor

of 100; 1,000; or 10,000? It’s trivial to calculate. Our valuation would then

be $5 billion, $50 billion, or $500 billion. We’re thinking way too small here.

Guys, think about that video that Ellen showed us—those kids playing with their

QEs. Out of the more than 8.7 billion people on this planet, they’re telling us

that only 159,563 people are gonna want Q-Phones and Quantum Counterparts that

can do that? Every parent who has ND$30 a month to spare is gonna want a QE.

Heck, they spend more than that just on their babysitters and twice that amount

on their mobile carriers right now anyway. OLA Facebook has over 3.5 billion

clients. We can do that too. Then what’ll we be worth?

“We don’t need these guys. Aziz has the deal with Costco Finance lined

up—that’s way more money than BVP and Cain are offering us. Costco’s giving us

a first tranche of $50 million of consumer debt financing for our first 159,563

customers, and they’ll keep right on growing with us. And it’s free money, or,

at least, it doesn’t cost us any equity. The way I see it, debt, even at around

16%, is way cheaper than giving away our equity which has a return of 363

friggin’ percent. BVP and Cain are taking advantage of us.” This is the longest

speech Damien has ever given on the topic of business and finance and, by far,

his most passionate.

As they leave to get in Angelo’s huge Bentley, Damien is also thinking now that

maybe Nell will get to marry up after all.

…

Mr. Keller’s brownstone is almost beyond comprehension. From the outside, it

looks like a quite nice, somewhat ornate, townhome; but inside, it’s a

completely different story. They go through security doors equipped with a

modern security apparatus that can look through you, smell you, and scan you

practically down to a cellular level. On the inside, this 32-room mansion is

really beyond description. The lot’s only 38 feet wide and 120 feet deep, but

the structure, all four stories above grade and one below, occupies almost all

of it. By Ellen’s calculation, there is some 19,000 square feet of living

space, and every cubic foot (she is back to using imperial units now that she

is back on home turf) is filled with antique wall coverings, Grand Master art,

antique furniture, rare vases and knick-knacks, and floor coverings that even

Ellen has never seen, heard of, or walked on before.

Angelo decides to give Ellen a guided tour of the place. No one else seems to

be invited along.

“Would you like to start from the top and work our way down or the other way

around?” he asks her solicitously.

Ellen’s not completely blind to the fact that Angelo likes her. When you look

like Ellen, you are bound from around age seven or eight to recognize the symptoms.

“I would prefer to start at the bottom and work our way to the top,”

They get in an elevator; she supposes that even one floor is a bit much for a

guy who is over 100. But she quickly notices that there are five lower levels,

not one. Angelo has had his contractors mine the property and add four more

underground levels to an already incredible place.

“I figured, my dear, that since I owned the subterranean rights, I might as

well take advantage. The digging and shoring up of the structure to produce the

extra space took three years partly because I don’t like the noise and

vibrations. So, they worked only when I was away. It is so much more convenient

than having to move, don’t you think?”

“Uh, huh,” is all Ellen can think to answer.

In addition to servant quarters, there is a fully equipped home office for 17

employees, a gym and wellness centre, a lap pool, a sauna, a steam room, and a

garage with its own vehicle elevator accessed from a rear alley. There’s also a

hospital room and surgery with the most modern facilities you could find

anywhere. When you get to be over 100, you can never be too careful. Angelo has

his own private doctor in his entourage as well. One floor is given over

entirely to a library full of rare books and manuscripts.

“Ah, only the British Museum can outdo me actually,” he tells her.

When they get to the penthouse, she sees that this is the floor he actually

lives on. It has the not particularly offensive smell of a 100-year-old man.

His dressing gown is there and PJs, for later. He is kind of cute and a bit shy

as he shows her around.

“How do you think things are going at the office between Q-Computing and our

people?”

Ellen is careful now. She likes him, and he obviously likes her; but he has a

reputation comparable to a black widow, so she needs to be cautious. “OK.

Damien is a bit concerned about valuation. He’s quite sure we’ll get more—a lot

more—than 160,000 clients worldwide and that obviously affects our valuation.”

“What do you think?”

“I think he is right,” she answers straight away.

“So do I.”

This answer disarms her. She smiles at him. He beams back at her.

“Do you think we should join the others?” Ellen asks. They’ve been on this tour

for at least 40 minutes.

“Surely. Surely. But I was wondering if I could prevail upon you for one more

thing?”

“Uh, huh?”

“Well, I celebrate my 104th birthday next March. If you look around this room,

you will notice I collect art—some of it great art. I would like to give myself

an early birthday present.”

“Uh, huh?”

“Now if you think for a minute that it is inappropriate, my girl, you just say

so. You will notice I didn’t say anything to anyone about how today’s little

meeting came about—how you and Ash3r broke through our security and committed I

don’t know how many felonies in doing so.”

“Uh, huh.”

“I would like to commission a work of art by a world-renowned artist and friend

of mine, Walter Van Peel. Do you know him?”

“Uh, huh.” Ellen is beyond being able to say much of anything at this point. It

is, by far, the strangest situation she has yet to experience. But she manages

to croak out, “What would this commission be?”

“Well, hmm, it would be of you, of course. In the nude.”

“Mr. Keller—”

“Please call me Angelo.”

“Angelo, do you think that’s the right thing to do? We are trying to do a deal

with your firm; there is a clear conflict of interest here.”

“In every way, it’s the right thing to do. I assure you that it will only be

for one person to enjoy and cherish, and that person will be very discreet. I

think it will also be an important work of art. I would like you to consider

posing for Walter. He would come to you at your place of choosing, and he is

very much a gentleman with respect to ladies. You can be sure of, ah, the

utmost respect for your person. Walter loves women’s bodies but only from an

art-world perspective. He has no interest in, say, carnal knowledge of a

women’s body, if you understand my meaning. I can vouch for him.”

This is Angelo’s very roundabout way of saying that Walter is gay. Another gay

guy in Ellen’s life. Sheesh.

“If you prefer, we can wait until we do a deal or don’t do one with

Q-Computing. Then, there would be no possibility of conflict of interest. I

must say that, in return, I am a powerful man, and if you were ever to need

anything—regardless of the outcome of the deal—you would be able to come to me,

and I would unreservedly assist you,” Keller adds as forcibly as a nearly

104-year-old man can.

“Angelo, I will think about it, OK?” Ellen steps next to the old man, wraps her

arms around him, and gives him a full-on hug that Angelo will cherish for the

rest of his life, which, remarkably, is still quite long.

…

The next day, BVP and Cain Caruthers come to them with a revised term sheet.

The valuation is greater by a factor of ten; so, without a lot of further fuss,

they agree on the deal points subject to MacMillan, Sheppard, and Seller LLP’s

review of the documents.

Ellen kind of seals it with this comment, “Look, Damien. I want their $10

million because money talks, and BS walks. But what I want more is for

Q-Computing to be plugged into their network of connections. There isn’t anyone

on the planet that we can’t talk to through them; it’s not six degrees of

separation, it’s two. Remember why you wanted that deal with Apple? It’s so we

can rely on their tens of thousands of patents and army of lawyers. Same thing

here, only it’s political and media related instead of business related. In my

opinion, it’s more of a strategic move than a financial decision.”

On the flight back to Toronto, they put the finishing touches on their business

model. There’s a 1% royalty on revenues, which they will give back to U of T

for ten years in return for their university’s past and continuing support and

use of its lab space, plus all the R&D they’ve done there.

Ellen wins most of the battles, but Damien is insistent on one point: there

will be no Q-Phone resellers in their model and, of course, only one supplier

of QEs.

“Look, we could probably get more capital with fewer strings attached from

strategic partners like established carriers or ISPs, but we don’t need them or

want them. They’re in the business of selling bandwidth and finding new ways to

soak clients. Their customer service sucks; we’ll just drive them out of

business.”

Ellen isn’t so sure. She thinks a kind of co-opetition model might work fine

for Q-Computing, but Damien won’t budge on this. At least, she got the go-ahead

from him to turn Anthony loose on the world’s two largest search engine firms.

She’s certain that del Castillo will be able to get rights fee deals from them,

which will eclipse the funding they got today from BVP and Cain Caruthers as

well as the financing commitment they already had from Costco. She thinks the

search services will either make a deal, or QEs will put them out of business,

effective nearly immediately.

The last element that gets a lot of debate amongst the five of them is the role

that QEs will play in revenue generation. Again, Damien is adamant. “I’m not

having QEs break stride to parrot some kinda advert. That would be perverse,

inauthentic, and totally unacceptable. These creatures don’t deserve that type

of treatment.”

“Does that mean you’re coming around to my way of thinking, Damien—that these

are sentient beings?” Ellen asks.

“I don’t know. I am still not sure we can make that determination. But they

appear to be able to closely mimic sentience, which might be the same thing.

“You know I read a book when I was a teenager. One of the offbeat characters in

the novel—a constable, who was also my favourite—said, ‘The difference between

ignorant and educated people is that the latter know more facts. The difference

between stupid and intelligent people—and this is true whether or not they are

well educated—is that intelligent people can handle subtlety. They are not

baffled by ambiguous or even contradictory situations; in fact, they expect

them and are apt to become suspicious when things seem overly straightforward.’

“I think that might be a good test for QEs, and everything we’ve seen so far in

our data suggests that they can handle subtlety and ambiguity.”

“Which book was that?” Ellen asks.

“It was Neal Stephenson’s The Diamond Age, also known as A Young Lady’s

Illustrated Primer.”

At the mere mention of young ladies, Traian is all ears. He stares at Damien,

thinking that maybe some of him has rubbed off on Damien too. “What kind of

book is it?” is all he says.

“It’s not what you’re thinking, Tray.

“Look we’re not going to ask QEs to work for us for nothing. In fact, it

wouldn’t surprise me if guys like Ash3r and Pet3r get hired to do work for

people or corporations on their own merit—they deserve it. And if they earn

their own living, who are we to take their money? Then they would be slaves,

Ellen. Do you want to own a slave?”

Ellen does not.

By the end of their trip to Boston, their business model looks like this:

Back in T.O., Damien unilaterally makes one change. He deletes

resellers. The very next thing he does is visit the university’s Institute for

Aerospace Studies up on Dufferin; he wants to check out their Space Flight Laboratory

and deep-space communications gear. He’s got another idea in the back of his

mind.

…

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.